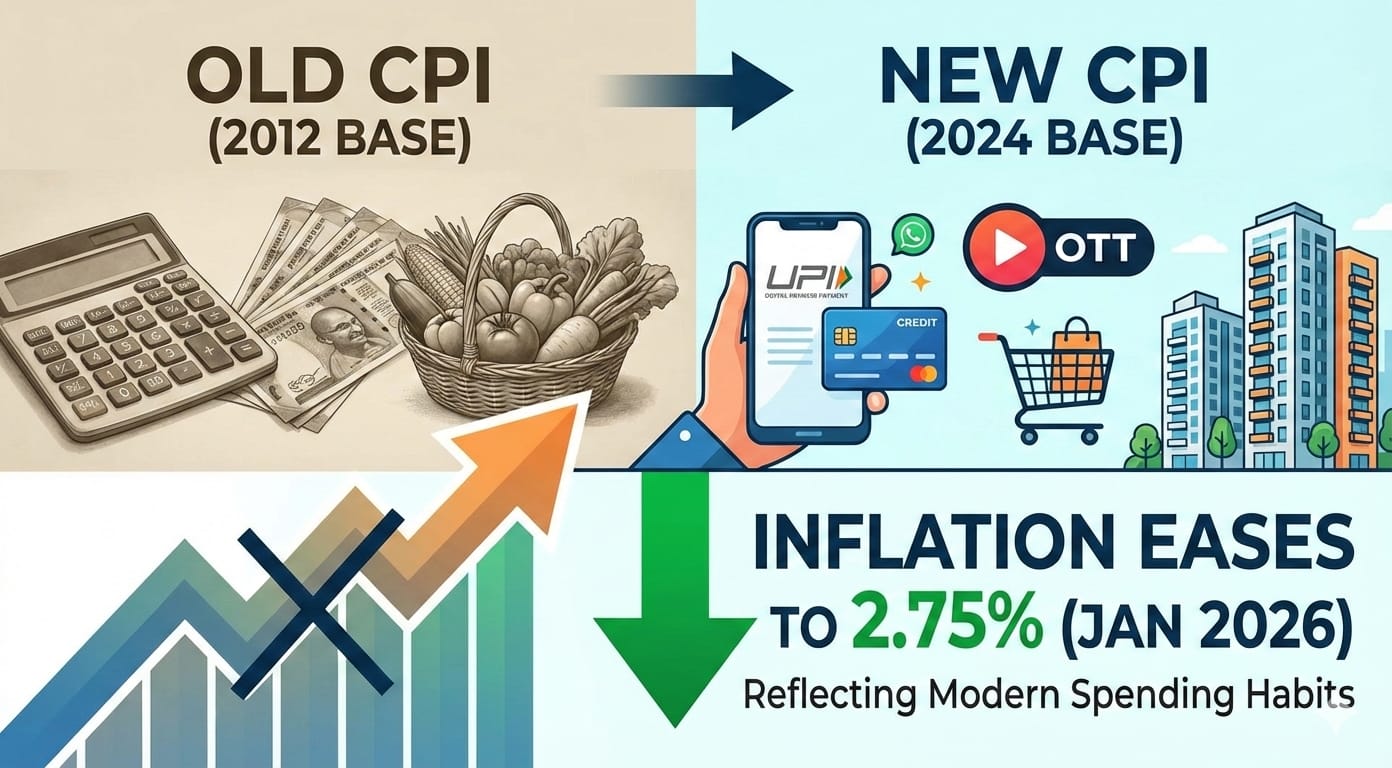

There has been a new twist in India inflation story. The retail inflation number of 2.75% in January 2026, according to the Ministry of Statistics and Programme Implementation (MoSPI), has set the tone for a brand-new Consumer Price Index (CPI) 2024 series in India. This change affects not only the methods for measuring inflation but also the implications it has on budgets and finances. The last change occurred with the CPI 2012 base, and since then, India’s economy and buying habits have evolved significantly – ranging from digital payments, internet buying, new lifestyle patterns, and changing rural markets.

The CPI 2012 series has been relying on the 2009-10 Household Consumption Expenditure Survey (HCES), data that encompasses an era with cash payments and fewer services payments, measuring 45.86% food & beverages (rural, 54.18%, and urban, 32.81%), and only 299 weighted items (goods, 259, and services, 40).

In contrast, CPI 2024 draws from the latest HCES 2023-24, reflecting post-pandemic shifts like digitalization, urbanization, rising incomes (lowest decile spending has doubled in 10 years) and service sector growth – whose weight of food & beverages is just 36.75 percent; housing at 17.66 percent (from 10.07 percent), while expanding 358 items in total (308 goods, 50 services).

There were additions like rural housing, OTT/streaming (Netflix and Amazon Prime), pen drives, babysitters, and online prices out of 12 e-commerce markets to reflect modern habits, while obsolete items (VCRs, tape recorders, second-hand clothes) were deleted.

It has adopted the UN’s COICOP 2018 (12 divisions vs 6 groups) for global comparability and covers 1,465 rural + 1,395 urban markets (up from prior) with the tablet-based CAPI collection and admin data (GST, TRAI). MoSPI Secretary Saurabh Garg noted this makes CPI “representative of current patterns” amid structural changes, and reduces food volatility’s impact to allow for stable signals – ideal for RBI’s 2-6% target.

Therefore, the new figure ( year-on-year over January 2025 under the new base 2024 series) of 2.75% might look higher than 1.33%December estimate under the old series, but here lies the catch – it can’t be compared directly, owing to the fact that the entire CPI basket has now been restructured. Food and beverages, for example, now account for 36.75% of the index, down from 45.86%, with housing, core items, and services gaining greater weight.

Recalibration of the CPI basket may reduce the extent to which food price fluctuations influence overall inflation, but it does not eliminate their impact. Food prices will continue to play an important role in shaping inflation trends, particularly in the short term.

For everyday citizens, the headline number is of significance “as it impacts everything from rates on loans to monthly budgets.” The Reserve Bank of India (RBI) has a target range for inflation between 2% and 6%, and the current print continues to remain well within the comfort zone (RBI, n.d.). Interestingly, despite the print falling short of experts’ expectations after the headline number for March was announced last week, there is now a growing belief among them that inflation is likely to firm up in the coming months as base effects taper off and food prices gain ground again. A dip in food inflation (2.13% in January, per MoSPI) helped keep overall prices in check, but volatile metals — especially silver — played spoilsport, with prices of silver jewellery up a staggering 159.67% year-on-year.

Economists like Aditi Nayar of Icra note that core inflation driven by housing, transport, health, and education and thus inflation with less input from food could quite possibly emerge as the dominant driver. And that is a big deal because it changes how the RBI acts. “Policy action may now focus more on demand pressures rather than temporary food shocks,” explained Chief Economic Adviser V. Anantha Nageswaran, quoted by MoSPI. Finally, he noted that the new CPI more accurately measures the costs of housing in rural areas, allowing the government to create more effective poverty and welfare programs. In conclusion this update allows policymakers to have a clearer view of the real cost of living.

The big picture? The new CPI series makes India’s inflation measurement more in sync with today’s economy — where services, housing, and consumer goods weigh more in wallets than food alone. For the average household, inflation below 3% feels like a breather, especially after the sharp swings seen between mid-2025 and late 2025 when food prices had actually turned negative. Yet, as global commodity prices, rural wages, and gold demand rise, economists warn that stability may not last forever. One thing’s sure: with the new CPI 2024 base, we’re not just tracking prices — we’re tracking a changing India.