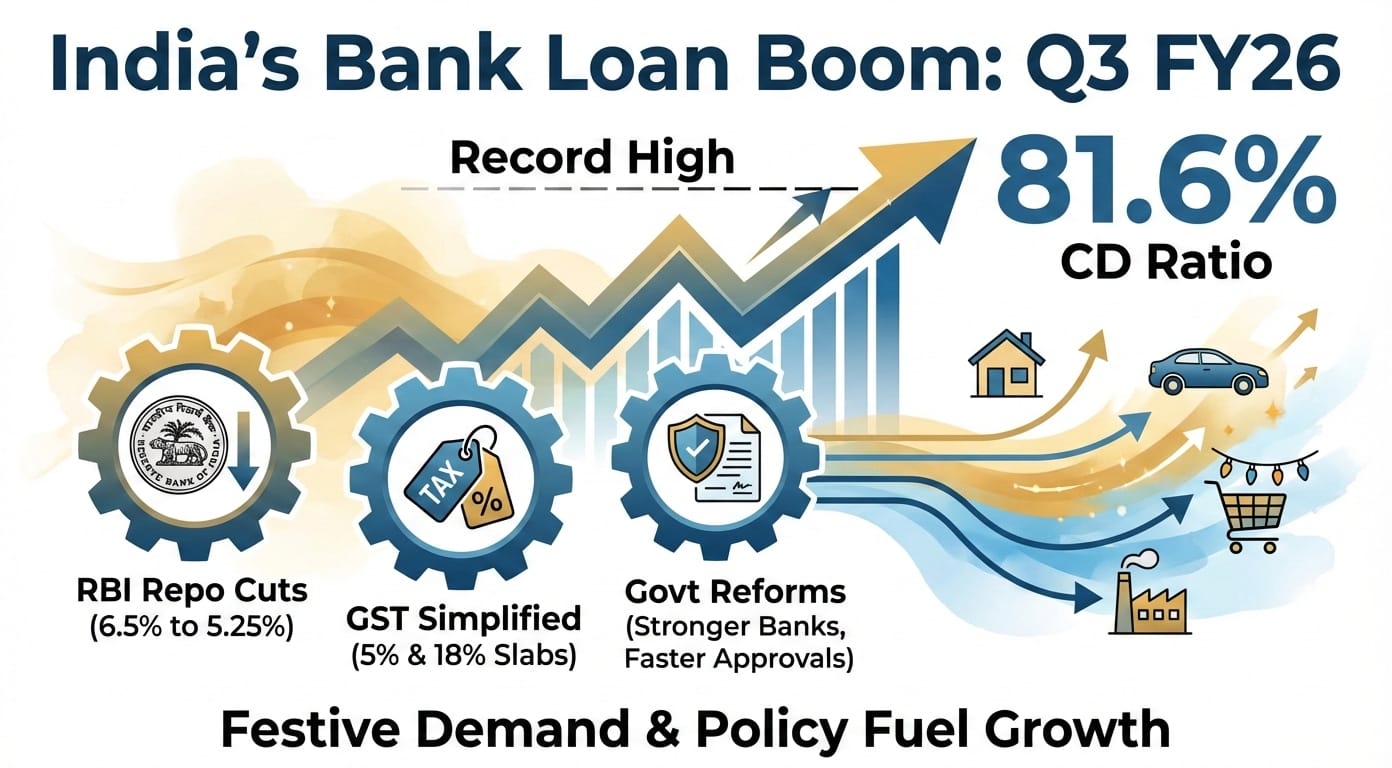

India’s banks are lending money like never before, especially during the October-December 2025 quarter (called Q3FY26). According to fresh data from the Reserve Bank of India (RBI), the credit-deposit ratio — a simple measure showing what share of people’s savings in banks is being turned into loans — reached a record high of 81.6 per cent by December 15. This means banks are putting most of their customer deposits to work by giving out loans, a sign of booming demand.

Why the big jump? RBI cut its repo rate (the interest rate at which it lends to banks) by 125 basis points — think of it as a small percentage cut — from 6.5 per cent to 5.25 per cent between February and December. Cheaper loans from RBI meant banks could offer lower rates to you and me, sparking more borrowing. Add to that the government’s GST overhaul on September 22: it simplified taxes into just two easy slabs of 5 per cent and 18 per cent (down from complicated multiple rates). Prices fell, wallets opened wider during festivals like Diwali, and demand for car loans, home loans, and personal spending shot up.

Banks shared their early numbers, and they’re impressive. Public banks shone bright: Bank of Maharashtra grew loans 19.6 per cent, Central Bank of India 19.6 per cent, Bank of India 15.1 per cent, Bank of Baroda 13.5 per cent, Punjab National Bank 10.2 per cent, and Union Bank 7.4 per cent. Private stars included HDFC Bank (up 11.9 per cent to ₹28.44 lakh crore), Kotak Mahindra (16 per cent), and Axis (14.1 per cent). Overall, loan growth ranged from 7 per cent to 20 per cent. “This quarter showed the real power of GST cuts — more auto loans, personal loans, and retail borrowing,” said Suresh Ganapathy from Macquarie Capital.

But the story gets even better when you look at recent banking reforms by the current government. These changes over the past few years cleaned up bad loans, made banks stronger, and created a fresh regulatory framework (new rules and guidelines) specifically for credit. Banks now have simpler ways to check borrower reliability, speed up approvals, and focus lending on key areas like small shops, farms, homes, and green projects. The result? Today’s loan boom isn’t just festive hype — it’s the payoff from these reforms building trust and efficiency. With cleaner books and smarter rules, banks feel safe expanding credit without big risks. RBI helped too, by cutting the CRR (cash reserve ratio — the money banks must park idle with RBI) by 1 per cent and buying back bonds to pump extra cash into the system.

Deposits grew too, but slower — from 3.4 per cent to 15.3 per cent. Bank of Maharashtra led at 15.3 per cent, Central Bank at 13.2 per cent, while Punjab National Bank (8.3 per cent) and Union Bank (3.4 per cent) lagged. Axis Bank bucked the trend with 15 per cent deposit growth beating its loans. “Watch deposits closely — they’re growing slower due to people saving in stocks or gold instead of banks,” noted Prakash Agarwal from Gefion Capital. High ratios like HDFC’s 99.5 per cent and Axis’s 92.8 per cent mean banks must hustle for more savings or borrow elsewhere.

Analysts are upbeat. Santanu Chakrabarti from BNP Paribas sees 13 per cent credit growth for FY26, thanks to liquidity, GST perks, and strong bank balance sheets. “Reforms and RBI steps let banks lend more with the same deposits,” said Anil Gupta from ICRA. This mix of easy money, tax relief, and solid reforms is firing up India’s economy — one loan at a time.