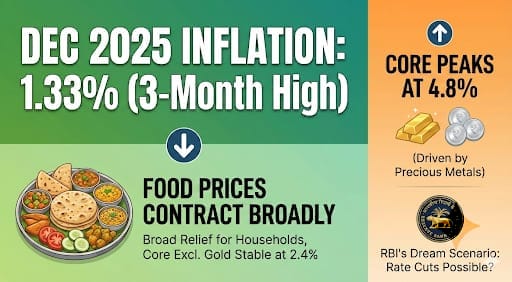

India’s retail inflation painted an intriguing picture in December 2025, ticking up to a three-month high of 1.33%—yet this number still lounged comfortably below the Reserve Bank of India’s lower comfort level of 2%, according to the latest Consumer Price Index data dropped by the Ministry of Statistics and Programme Implementation on January 12, 2026.

For everyday folks juggling grocery bills and fuel costs, this might sound like a mixed bag: inflation quickened from November’s even lower levels, but the overall trend screams relief because prices fell across multiple sectors, keeping the headline CPI way under the RBI’s 4% target with its 2-6% tolerance band. Imagine biting into your morning paratha without wincing at the onion price— that’s the vibe here, driven by a broad-based cooldown that experts say could pave the way for easier monetary policy ahead.

Diving into the numbers, the food and beverages basket, which packs a hefty 46% weight in the CPI, contracted by 1.85% in December, softening from a sharper 2.8% dip the month before. This moderation ties back to a high base effect—remember how food inflation raged at 7.7% in December 2024?

That lingering shadow made this year’s figures look tame by comparison. But hold on, not all veggies are playing nice; Madan Sabnavis, chief economist at Bank of Baroda, flags that meat products, oils, and fruits are inflating over 5%, whispering warnings of upward pressure in the months to come. Cereals eased too, dropping to -0.5% from deeper negatives, while pulses and spices held their ground without much drama. For households, this means your thali stays affordable, but watch those festive fruit baskets—they might pinch a bit more soon.

Other categories chipped into the deflationary tale. Pan, tobacco, and intoxicants stayed rock-steady at 2.96%, unchanged from November, showing addicts and occasional puffers aren’t feeling the squeeze. Clothing and footwear saw a gentle slide to 1.44% inflation from 1.49%, a far cry from the 2.7% spike last December—good news for Diwali shoppers hunting last-minute deals into the new year.

Housing inflation cooled marginally to 2.86% from 2.95%, as rental pressures eased in urban pockets, and fuel and light trimmed to 1.97% from 2.3%, thanks to steady global crude prices and subdued domestic demand. Even electricity tariffs didn’t jolt consumers much, painting a picture of stability in essentials that power daily life.

Now, here’s where things get a tad spicy: core inflation, which economists love because it excludes volatile food, beverages, fuel, and light (plus petrol-diesel for vehicles), surged to a 28-month peak of 4.8% in December from 4.4% prior, as highlighted by Aditi Nayar, chief economist and head of research at ICRA Limited. Sounds alarming, right? But peel back the layers, and it’s largely precious metals like gold and silver flexing their festive-season muscles—RBI wedding and investment buys pushed those up. Strip them out, and core CPI excluding gold-silver holds flat at 2.4%, signaling underlying demand remains tame. Nayar’s take underscores why policymakers aren’t panicking yet; it’s more noise than signal for now.

Zooming out, this December print caps a stellar 2025 for inflation control, with annual average CPI likely settling under 4% for the first time in years, bolstered by bumper harvests, supply chain fixes post-monsoon, and government subsidies on essentials. Rural inflation, often a headache, mirrored urban trends at around 1.2% approx, narrowing the gap that usually fuels disparities.

For the RBI, staring down its next policy meeting, this data is music—low headline inflation hands them ammo for potential rate cuts, maybe 25 basis points soon, to juice up GDP growth hovering near 6.8% projections. But questions linger: will El Niño risks in 2026 reverse food fortunes? Or will core stubbornness force a pause?

In simple terms, December’s 1.33% is like a speed bump on a smooth highway—nothing to derail the journey toward price stability. Families save on staples, businesses plan expansions without cost freakouts, and investors eye bonds over equities. Yet, as Sabnavis cautions, sticky proteins and tropics could stir the pot. Credit to MoSPI for timely data, and analysts like Nayar and Sabnavis for sharp insights—this broad decline isn’t luck; it’s policy, weather, and markets aligning just right.