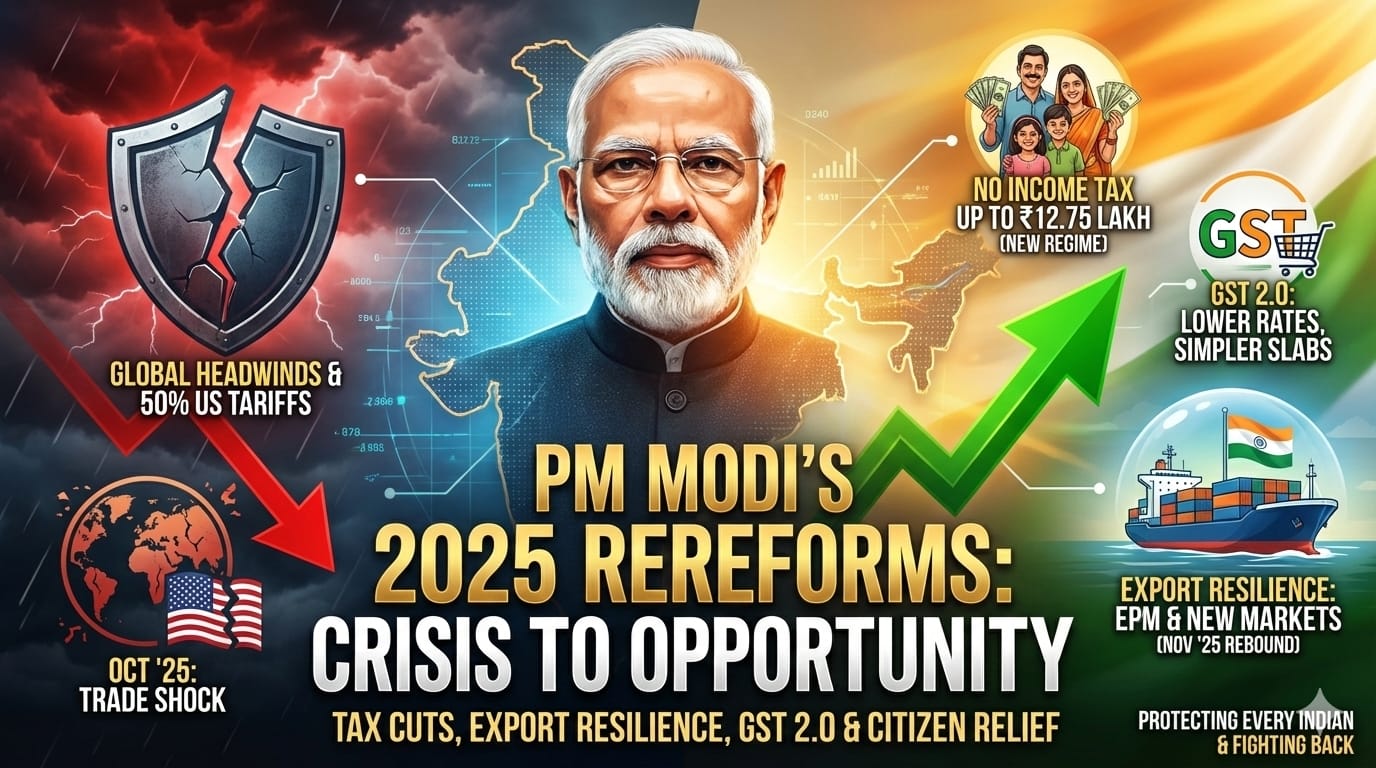

From tax cuts to export resilience under 50% US tariffs, 2025 became the year India protected the common man at home and fought back in global trade.

2025 will be remembered as the year when India’s policy establishment stopped merely reacting to crises and instead rewired the economic and security architecture to protect and empower the average citizen. The most visible starting point was the dramatic income-tax reset.

When Finance Minister Nirmala Sitharaman announced that there would be no tax on income up to ₹12 lakh a year under the New Tax Regime, effectively pushing the tax-free threshold to ₹12.75 lakh for salaried taxpayers with standard deduction, it was a direct transfer of purchasing power to the middle class and lower middle class.

This jump from the earlier ₹7 lakh threshold under the same regime did more than create feel-good headlines; it freed up EMI-stressed households, boosted discretionary spending, and gave small businesses a fresh demand base at a time when global headwinds and higher interest rates could easily have choked India’s consumption engine.

This domestic relief came in the same year when India faced one of the harshest external shocks in recent memory: the Trump administration’s decision to impose tariffs of up to 50 percent on Indian exports to the US from August 27, 2025.

Reports noted that the US Customs and Border Protection notified that most Indian-origin goods could see effective duties climb close to 50 percent, with new codes and “privileged foreign status” rules reshaping how Indian shipments are treated in US foreign trade zones.

Analysts pointed out that sectors like engineering goods, textiles and some value-added products would lose price competitiveness overnight, with some estimates warning that affected shipments could see severe volume losses in the short term. This was effectively a stress test for India’s export resilience, and the way the government responded is central to understanding 2025 as a turning point.

Instead of retreating, the Modi government moved to structurally rewire the export ecosystem through the Export Promotion Mission. The Union Cabinet approved the EPM with an outlay of ₹25,060 crore for 2025–26 to 2030–31, consolidating fragmented schemes into a single, adaptive export framework focused on MSMEs, first-time exporters and labour-intensive sectors.

The Mission aims to use technology, targeted support and fast policy response to global shocks, precisely the kind of architecture needed when a major partner like the US suddenly raises tariffs to near-embargo levels. For the common Indian worker in a garment unit in Tiruppur, an auto components cluster in Pune or a pharma SME in Hyderabad, such a mission means a government attempting to keep export orders flowing, jobs secure and wages stable despite hostile foreign policy moves.

The results began to show up in the trade data narrative. After merchandise exports fell around 12% in October, Commerce Minister Piyush Goyal stated that November saw “healthy growth” and that exports in November rose by more than what was lost in October, so that October–November combined still showed growth despite global turmoil.

Coverage by outlets like NDTV and Times of India underlined this rebound, reporting that shipments “picked up after the October slump” and that India’s exports were “back in positive territory” in November. Even though the detailed numbers were to be released later in December, the policy message was clear: in the first full month after US tariffs kicked in at full force, India’s export engine did not collapse; it adjusted, diversified and pushed back, with the EPM framework and ongoing FTAs giving exporters breathing space. For the ordinary Indian, this resilience matters because exports are not just about GDP—they are about factory shifts not being cut, migrant workers not being sent back, and ancillary service jobs staying intact.

On the domestic front, GST 2.0 became another big lever to shield citizens and businesses from both inflation and compliance fatigue. By scrapping the 12 percent and 28 percent slabs and cutting rates on a range of goods and services, GST 2.0 moved the system towards fewer slabs and lower rates for essentials, healthcare and insurance.

That meant lower tax incidence on consumption, improved affordability of medical cover, and reduced cost pressure on manufacturing and services—especially vital when export margins were under stress due to external tariffs. This reform complemented the income-tax relief: one gave households more money in hand, the other made the basket of goods and services relatively cheaper. Together, they softened the blow of global disruptions and strengthened India’s case as a destination with both growing domestic demand and a cleaner, simpler indirect tax regime.

The insurance and energy reforms of 2025 also carried a clear citizen-centric undercurrent. Raising FDI in insurance to 100 percent through the Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill is not just about pleasing foreign investors; it is about bringing in capital, innovation and competition in a sector where India’s protection gap is still huge.

More capital and more players can translate into better products, faster claims and potentially lower premiums over time, which matters deeply to a lower-middle-class family that has just begun to buy term insurance or health cover. Similarly, the SHANTI Bill opened the door for private and joint-venture participation in civil nuclear energy, aligning with the target of 100 GW nuclear capacity by 2047.

In a country where rising power demand often translates into higher bills for consumers and pollution for cities, unlocking nuclear capacity is about giving households cleaner, more reliable electricity and making industrial growth less carbon-intensive.

At the same time, schemes like the Pradhan Mantri Dhan Dhaanya Krishi Yojana and the approval for the 8th Central Pay Commission spoke to rural and salaried India’s long-term security. PMDDKY’s focus on 100 underperforming districts and 1.7 crore small and marginal farmers is designed to attack chronic agricultural distress by pooling 36 schemes and pushing water, productivity and market access together.

That kind of deep, district-level intervention is what can turn annual loan waivers into sustained income growth for the farmer’s household. The 8th Pay Commission, with expectations that the minimum basic salary could eventually rise from ₹18,000 to the ₹32,940–₹44,280 band depending on the fitment factor, signals future increases in purchasing power for lakhs of government employees and pensioners, which tends to spill over into small-town consumption, housing demand and education spending.

Overlaying all this is a tougher national security posture through the new doctrine on terror, which declared that any attack on Indian soil would be treated as an act of war. That stance is not just strategic signalling to Pakistan; it is a reassurance to every citizen that the state is willing to deploy all instruments—diplomatic, military, and economic—to keep their lives and livelihoods secure. When combined with the National Sports Policy 2025 and the massive exercise of Census 2027 preparation, the picture that emerges is of a government trying to invest simultaneously in hard security, soft power, data systems and grassroots welfare.

Seen together, PM Modi government’s 2025 reforms form a coherent attempt to make India shock-proof at multiple levels: income stability through tax relief, price and business stability through GST 2.0, external resilience through the Export Promotion Mission in the face of 50 percent US tariffs, social protection via insurance and agriculture schemes, and long-term capacity through nuclear energy and sports policy.

For the average Indian, this is not an abstract policy collage; it is a year in which salaries stretched a little further, jobs in export-linked factories were protected from the worst global blows, healthcare and insurance became more reachable, and the state’s posture—on both terror and trade—felt more assertive and confident.