MoSPI's revised GDP series with 2022-23 as base year puts India's full-year FY26 growth at 7.6%, beating earlier estimates — here's the full picture...

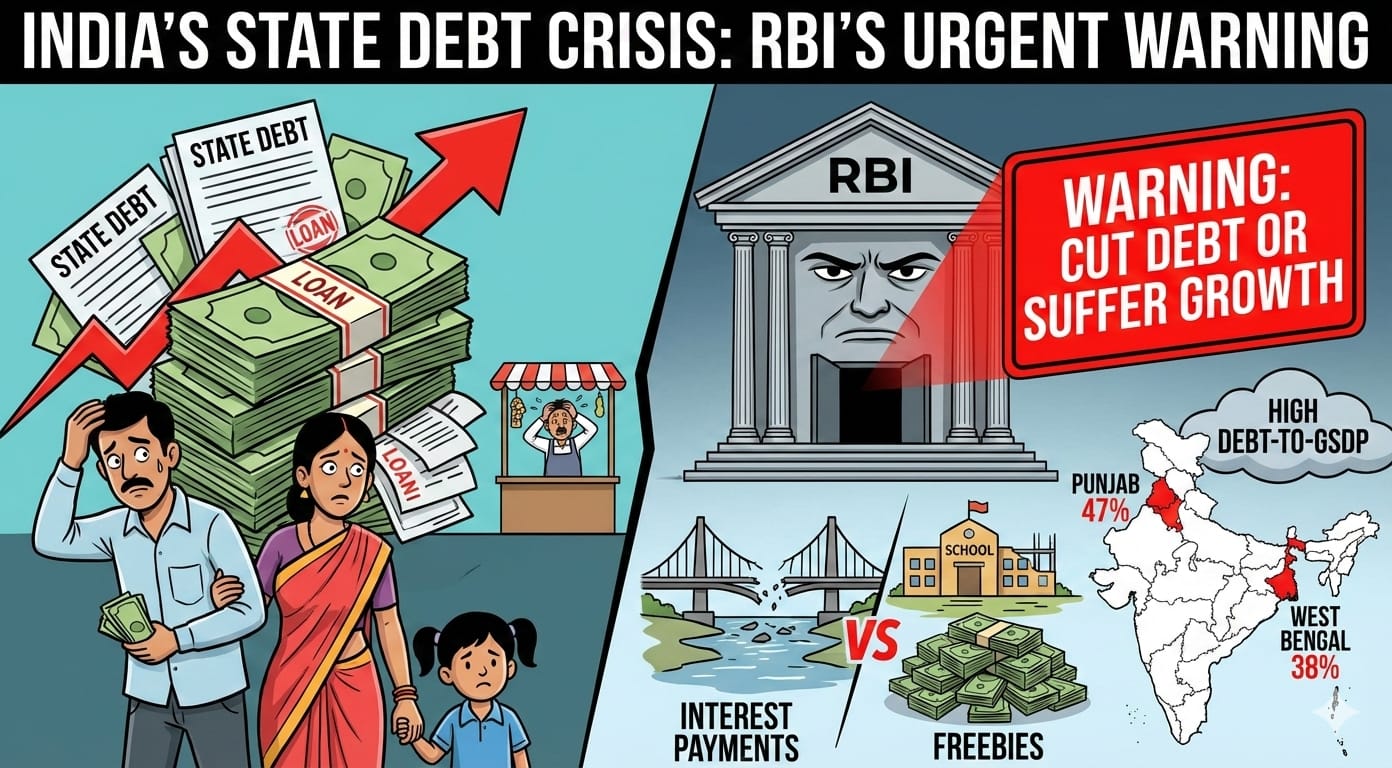

The Reserve Bank of India recently issued a report titled “State Finances: A Study of Budgets 2023–24.” With the report, the central bank has sent a clear alarm to all states. ...

Strong recoveries, fewer fresh defaults, and cleaner loan books help India’s banking system keep improving, even as small finance banks see stress rise....

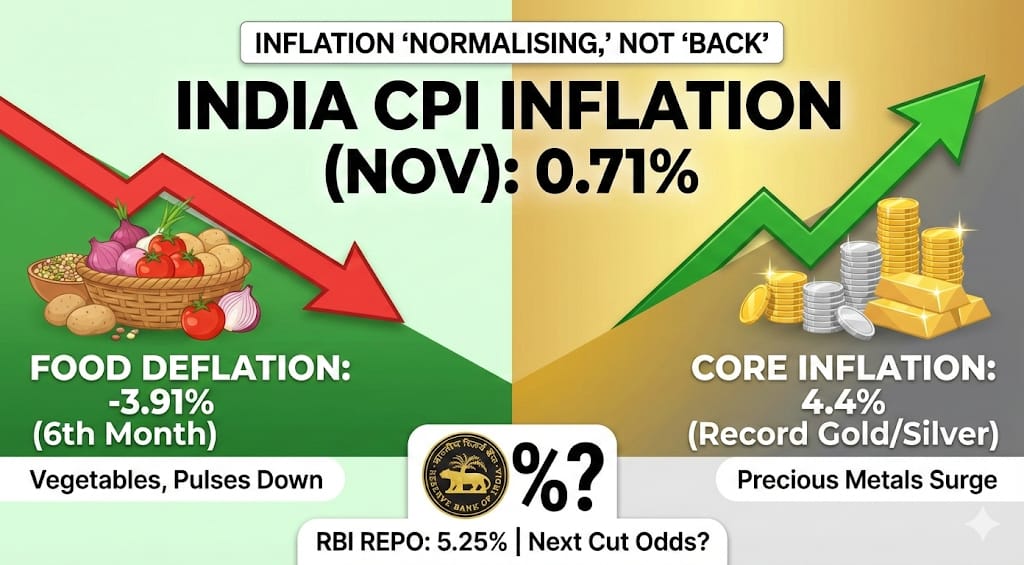

India’s CPI inflation rose to 0.71% in November from 0.25% in October, mainly due to an unfavourable base effect....

RBI cuts repo rate by 25 bps to 5.25% amid record-low inflation and stronger growth, announces Rs 1.45 lakh crore liquidity infusion; Nifty and Sensex edge higher as banks, realty and autos lead the p...

Out of the 50,811 credit card complaints, a massive 32,696 were against private banks, showing how sharply the complaints map onto the aggressive expansion of private card businesses....

Discover why India’s Q2 FY26 GDP growth is set to exceed the RBI’s 7% forecast, driven by strong consumption, government spending, and low inflation, while exploring how India consistently outperforms...

RBI announces trade relief measures including loan moratorium, export credit extension, and FEMA relaxations to ease debt burden on Indian exporters....

GST cuts and festive demand have doubled bank credit in India, driving record growth in loans, housing, autos, and consumer goods through September and October 2025....

The consistent addition is part of a larger RBI plan to bring back gold and increase India's financial reserves. This is critical to achieve economic security and stability amidst turbulent global pe...