Karnataka was once cited as a rare Indian state that combined welfare with fiscal discipline. It ran revenue surpluses, invested steadily in infrastructure, and built a reputation that attracted capital, talent, and long-term confidence.

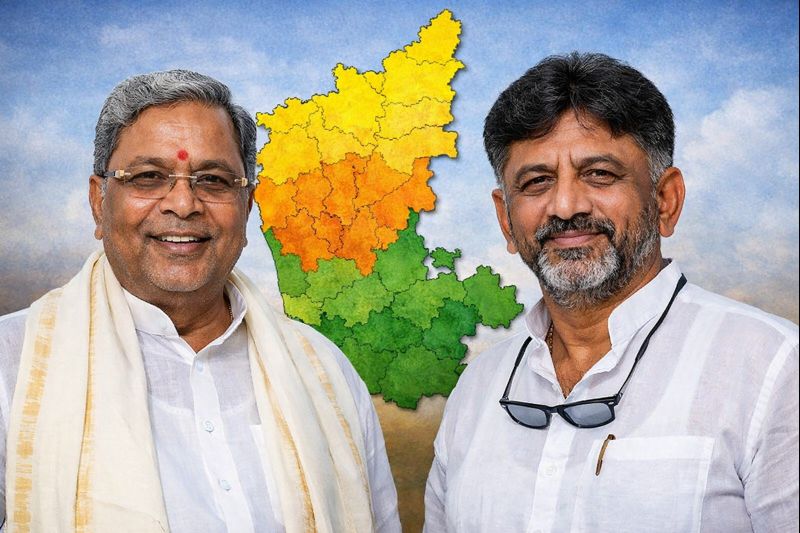

Less than three years after the Congress returned to power in May 2023, that reputation lies in ruins. What has unfolded instead is a textbook case of fiscal mismanagement driven by populism, administrative paralysis, and a dangerous addiction to debt.

This is not a story of one bad budget or an external shock. It is the story of a deliberate policy choice that has pushed Karnataka from prudence to precarity.

From surplus to deficit

The clearest marker of decline is the collapse of Karnataka’s revenue balance. Just before the Congress took charge, the state maintained a revenue surplus, meaning it earned more than it spent on salaries, pensions, and routine administration. That discipline ended under Congress.

By 2023–24, Karnataka slipped into a revenue deficit. By 2024–25, the deficit widened sharply, signalling something far more serious than a temporary imbalance. The state is now borrowing not to build assets but to pay bills. Salaries, pensions, subsidies, and guarantees are being financed through loans. This is the most basic red flag in public finance.

Fiscal deficit numbers tell the same story. In just two years, the deficit has surged close to the statutory ceiling of 3% of GSDP. Debt has climbed towards the 25 % FRBM limit, leaving the state with almost no borrowing headroom. In September 2025, the finance department formally acknowledged what markets already knew: Karnataka had hit its borrowing ceiling.

A state that once planned its finances is now living quarter to quarter.

Panic borrowing and the Q4 shock

Nothing captures this desperation better than Karnataka’s borrowing pattern. In FY26, the state borrowed barely ₹12,000 crore in the first nine months. Then came the shock. In the final quarter alone, Karnataka lined up loans worth ₹93,000 crore, the largest Q4 borrowing by any Indian state in history.

This is not strategic financing. This is panic borrowing.

Well-run states spread their borrowing evenly across the year to manage cash flows and interest costs. Backloading nearly the entire borrowing programme into one quarter signals a cash crunch so severe that the government is effectively using debt as an overdraft facility just to close its books.

With total liabilities now approaching ₹7.6 lakh crore, Karnataka is no longer borrowing for growth. It is borrowing to stand still.

The guarantee trap

The Congress government’s defence is familiar. The five guarantees, it argues, are “investments in people.” In reality, they have become a structural trap.

Together, Gruha Lakshmi, Gruha Jyoti, Anna Bhagya, Shakti, and Yuva Nidhi cost over ₹50,000 crore annually. They consume nearly one-sixth of the state’s revenue expenditure. Worse, they are rigid and recurring. When revenues fall short, these schemes cannot be paused or scaled down. The axe falls instead on capital expenditure.

The Comptroller and Auditor General has already flagged the consequence. Capital spending fell sharply in 2023–24. Incomplete projects jumped by 68% in a single year. Karnataka is now dotted with half-built roads, stalled irrigation works, and frozen urban projects.

This is the guarantee model in practice: consumption today, decay tomorrow!

Contractors unpaid, infrastructure frozen

The human face of this fiscal collapse is visible in unpaid bills. Contractors are owed more than ₹30,000 crore across departments. Irrigation, education, public works, and urban development have all ground to a halt. Strikes and work stoppages are no longer threats; they are routine.

Even essential workers have not been spared. Kitchen staff serving mid-day meals in government schools went unpaid for months. Pensioners have had to approach courts for their dues. Salaries are delayed, loans are defaulted, and confidence is eroded.

A government that cannot honour its own contracts cannot govern!

Bengaluru paying the price

Nowhere is this more visible than in Bengaluru. Metro lines are delayed, flyovers abandoned, roads cratered, and traffic unmanageable. Projects announced with fanfare exist only on paper.

This matters because Bengaluru funds Karnataka. When infrastructure collapses in the capital, the state’s revenue base itself comes under threat. Investors have choices. Increasingly, they are choosing Hyderabad, where approvals are faster, and infrastructure works are.

FDI figures still look respectable, but they reflect legacy strengths, not current governance. Capital is patient, but not blind.

Debt without development

Congress leaders often point to headline GSDP growth to claim success. This argument is misleading. Growth is being driven by sectors built long before 2023: IT services, exports, and private enterprise resilience. The state’s own contribution through public investment is shrinking.

At the same time, interest payments are rising. Every new loan adds to future budgets already under strain. This is the classic debt spiral: borrow to spend, spend to survive, borrow again to repay interest.

Future governments will pay for today’s politics!

A warning, not a slogan

Karnataka’s crisis is not ideological. It is arithmetic. You cannot run permanent revenue deficits, freeze capital spending, pile up debt, and still claim to be pro-poor. Welfare without fiscal discipline ultimately hurts the very people it claims to help, through inflation, job losses, and collapsing public services.

What Congress has delivered in Karnataka is not a model but a warning. A strong state has been reduced to India’s biggest borrower. A development engine has been replaced by a distribution machine running on credit. And a reputation built over decades has been squandered in less than three years.

Fiscal mismanagement is not dramatic. It is slow, corrosive, and unforgiving. Karnataka is learning that lesson the hard way.

Written by Vibhava S Bykere